General questions

Q

Can I use AMI if I'm not subject to VAT or mixed subject to VAT ?

Of course !

A.M.I. creates invoices containing products and services

mixing different VAT rates.

So just select the 0% VAT for all your non-taxable services.

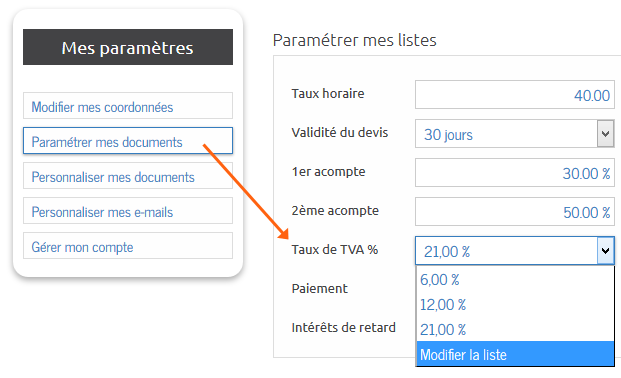

You can add any VAT rates in the section Parameters >

Set my documents

Yes

There are several ways to export your documents via the left toolbar:

- in

PDF format by clicking "Download PDF documents"

- in

printable format by clicking on "Print the period"

- in

CSV format importable into the accounting programs by clicking on "Export to CSV format"

For all your articles and your customers only the option "Export in CSV format" is available.

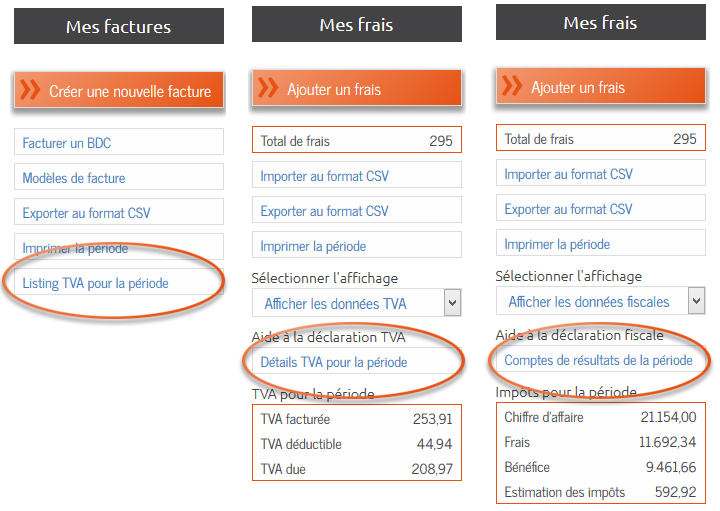

For the VAT listing, simply click the "VAT Listing for Period" button in the Invoices section.

It is also possible to export all CSV files simultaneously by clicking the "Export Accounting" button in the toolbar of the dashboard.

For professional expense accounting you can also export:

- in

CSV format

- in

printable format

- the

VAT summary

-

details of the VAT codes (for the declaration)

-

income statements for the tax period

Q

Is AMI suitable for companies working in the construction industry?

YES

The

business subjected to the cocontracting rule (construction, gardening, ...) can now declare it in the company's informations.

The cocontracting rule (0% VAT rate and legal notice) will be applied automatically to your documents if you select a professional client.

Of course, you could always change it yourself if it doesn't suit your needs.

Q

May AMI be used by non-professionals ?

Yes, the software may please the non-professionals who are selling second hands goods or wish to create professional looking documents.

Of course, a non-professional can't create invoices with VAT.

Simply select the "not subject to VAT box" :

- your articles will automatically show a 0% rate

- no mention to VAT will appear on your final document

Q

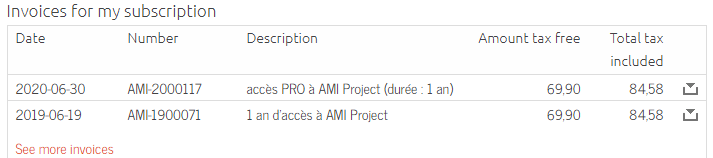

Where can I find my invoice for the purchase of an AMI Project access?

You will find the invoice related to your purchase in the section "

My settings > Manage my account".

This invoice is automatically generated when you pay for your access.

It is also automatically added to your professional expenses because the amount paid is

100% deductible in your accounting!

Q

Is AMI Project compatible with Mac OSX?

YES

Our online software is compatible on Mac OS, and on all platforms with a browser less than 5 years (smartphone, tablet, computer, ...).

Q

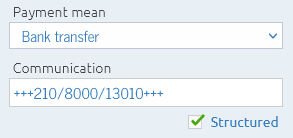

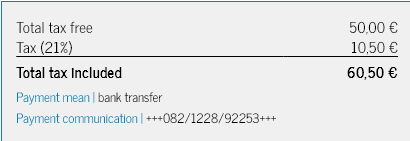

Bank payment communication

Payment communication

You can choose to add a structured or unstructured communication to your invoices.

This will enable you to identify your customers' payments more quickly.

Search by communication

You can also search by this communication.

Q

I am a TVA franchisee, how do I set up my account?

Your franchise status must be mentioned on all your documents

The legal mention is "Special franchise system for small businesses" (article 56bis of the VAT code).

You can add this mention in "My settings > Set up my documents > Add a text to all my documents".

ATTENTION: you can NOT charge VAT.

All your items must have a VAT rate of 0%.

We advise you to set your VAT rate to 0% by default in "My settings > Set up my documents > VAT rate".

Q

Change the duration of the active session

For the security of your data, your connection has a limited duration

By default, you will be logged out if you are inactive for more than 24 minutes.

A message will warn you 60 seconds before your session is automatically closed.

An inactive session means that you have not changed or reloaded the page.

If you want to increase this time, you can select 120 minutes in "My Settings > Manage My Account > Security" (not recommended).

Q

Can I use 2 accounts simultaneously?

You have several AMI Project accounts and you want to work on them at the same time?

Several solutions exist:

- use different computers

- use different internet browsers (for example Chrome and Edge)

- use different private sessions (create a new private browser window)

WARNING: for obvious security reasons you will not be able to connect with 2 different accounts on the same browser and in the same window (to switch from one tab to another).

Q

Can I use a VPN to connect to AMI Project?

YES

We strongly encourage our users to protect their data on the Internet.

VPNs, proxies, and other protected networks can therefore use AMI Project freely.

However, it is unfortunate that some hackers use these same networks to try to infiltrate our system (without success, fortunately).

We are therefore sometimes temporarily forced to block certain IP addresses.

If you get a 403 error on our site, it means that the IP address you are using has been blocked for security reasons.

Most VPNs allow you to change your IP address very easily, so you can access AMI Project again.

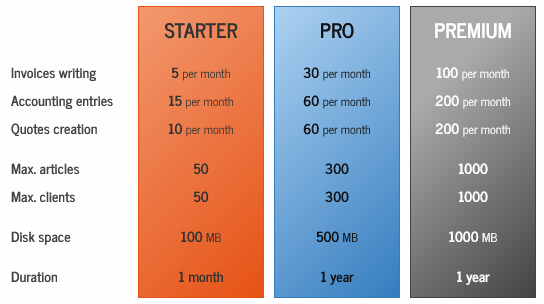

Access types

To purchase new access, go to

"My Settings > Manage My Account".

For online payments, AMI Project uses the internationally recognized secure platform:

Mollie.

The Mollie platform offers many payment solutions.

However, if you do not have any payment method offered by Mollie, you can pay by bank transfer directly by mentioning the order number in communication.

For more information, click on the link "Pay by bank transfer".

From January 1, 2017, AMI project has entered its paid phase.

However, free service is always guaranteed for TPE that can continue to create their bills (with a monthly limitation).

Q

My access is coming to an end, will my data be kept?

YES

You will of course keep all your data and can access it normally, whatever the type of access you choose.

The limitations related to the different types of access only concern the creation of future data.

Q

How can I increase the limits of my access?

Each type of access allows the creation of more or less data.

If you are limited in your creation, we advise you to purchase an higher access type.

When you buy a higher access type, your previous access is automatically converted in proportion to the quantity consumed,

you will never lose what you paid!

If you reach the limit of the highest type of access, please contact us for a personalized offer.

You can view the different types of access and their limitations on the "Account Settings" page.

Q

Can access be used by multiple simultaneous users?

Yes, there is no

limitation in the number of connections and it is possible to work on several documents simultaneously.

When subscribing, you choose the login (e-mail address) and password of your company, which can be used by all your collaborators.

To facilitate your internal communication it is possible to leave comments and "tags" (keywords) on your documents.

Q

Can I give access to my collaborators?

YES

You can add your collaborators in the section "My Settings > Manage my collaborators".

You can give access to one or more parts of your AMI Project account to your collaborators.

Q

You have reached the limit of your access

Your account limits depend on your access type

If you get a message that you have reached one of these limits, you can :

- wait if it is a monthly limit

- or buy a higher type of access

When you buy a higher access,

you do not lose your old one!

Your old access will be automatically converted into additional time (calculated in proportion to the remaining time).

ATTENTION: buying a second access of the same type will not increase your limits, it will only extend your current access!

Q

Can I change the password of the collaborators' accesses?

You cannot administer your collaborators' passwords

If their password is lost, they must click on the "Forgot password" link to receive a new password by e-mail.

Q

Does AMI Project offer subscription packages?

Purchased accesses are never automatically renewed

In order to give freedom to each user, we do not propose any subscription, so the accesses are not automatically renewed.

However the accesses are cumulative, if you buy a second access it will extend your current access.

When you need an access again, you just have to follow the usual payment procedure.

The invoice will be automatically generated and accessible in "My Settings > My Account".

Documents

Q

How do I view documents from previous years?

By default, AMI Project displays documents for the current year, but your old documents are of course still accessible.

The search system allows you to specify the period of the document to display :

- Either manually using the dates "From" and "To"

- Either by choosing a period from the drop-down menu

In addition, you can keep the search filter settings for all documents (until disconnected) by checking the corresponding box at the bottom right.

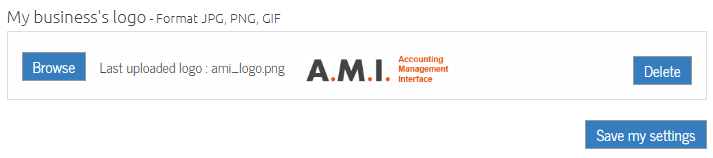

Your logo can be uploaded in

JPG, PNG or GIF format in the section "

My Settings > Change my details".

The image of your logo is always left aligned on your documents.

To avoid any misalignment, be sure to remove any white space on the left side of your image (using Microsoft Paint or Adobe Photoshop, for example).

The ideal resolution for your image is 650 x 230 pixels (which will correspond to a size of 6 x 2.2 cm on your documents).

Have you changed your colors, your contact information or your client's, but nothing has changed on your document?

This is normal, AMI Project uses a backup system that allows you to retain previously saved data.

To update a document, just edit it and save it again.

Q

How to add my general conditions of sale?

Import your terms and conditions

You can add your terms and conditions as a file or text in the "Set up my documents" section.

In your e-mails

If you use personalized e-mails (My settings > Personalize my e-mails) simply add the { Cgdv } tag to your e-mail and it will automatically create a link to your terms and conditions.

If you wish to add the words "I have read, understood and accepted the attached general sales conditions", you must select the "Attach to document" value for the "General sales conditions" tab in the side menu when you create your document.

By default, these 2 options have been activated when you created your account.

In your PDFs

When editing your document, select "Attach to document" in the left-hand menu.

Q

How to change the language on my documents?

The document will be saved in the language used on AMI Project

You can switch from one language to another by clicking on the corresponding flag in the top language menu.

If you want to change the language of a document already created, simply select the language, modify the document, and save it again.

Delivery slips

You can generate delivery notes linked to a purchase order or invoice.

You can specify the weight of each item, as well as delivery details (number of packages, shipper, tracking number, etc.).

The stock of your articles will be automatically updated when a delivery note is sent.

Article info

Encode your recurring articles for easy import onto your delivery notes.

Q

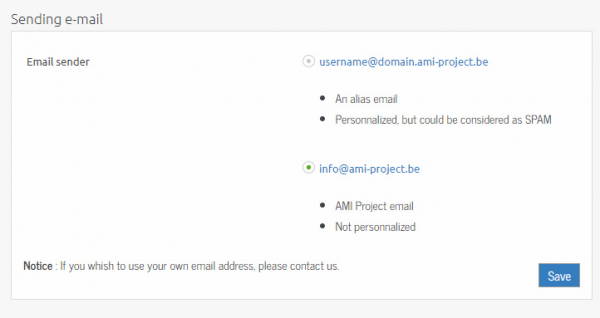

Why isn't my client receiving my emails?

The reception of e-mails may depend on the security of your customers' mailboxes

Some mailboxes may consider your mail as

junk mail.

If this is the case, they must click on "this is not spam" to legitimize the mail.

To get around this problem, you can use the e-mail address

info@ami-project.be for your mailings.

Go to the "My Settings > Manage My Account" section and select the sending email.

AMI Project is recognized by major mailboxes, such as Gmail or Hotmail.

Les termes TVAC (TVA comprise) et TTC (toutes taxes comprises) sont tous les deux valables légalement.

AMI Project utilise TVAC sur les documents, car le montant est calculé avec la TVA comme seule et unique taxe.

Certains secteurs (comme les hôtels par exemple) appliquent des taxes spécifiques, et la mention TTC est alors utilisée.

Si vous les souhaitez vous pouvez bien entendu préciser une remarque globale dans vos paramètres telle que :

"Le total TVAC calculé vaut comme montant TTC".

Q

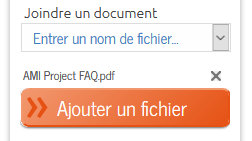

Can I add attachments to my documents?

YES

You can

add your attachments when editing your document by selecting the files in the toolbar (bottom left).

The links to the added attachments will then appear in the email sent to your customer, in the box below.

In addition, you can also specify your terms and conditions in your settings, either as text or by importing a file.

Q

Supplier purchase orders

Ordering from suppliers

Would you like to place an order with your supplier? You can do so directly on AMI Project!

Go to the "Articles" section to manage your suppliers and orders.

If necessary, you can also specify your delivery details.

The stock of your items will be automatically updated when a supplier order is delivered.

Q

How do I align my logo?

The image of your logo is always aligned to the top left

If there is a shift, it is most likely caused by a white area on your image.

To avoid a shift, be sure to remove any white space on the left side of your image (with Microsoft Paint or Adobe Photoshop, for example).

The size of the logo area is 650 pixels wide by 230 pixels high.

If your logo is larger than this area, it will automatically be adjusted to fit.

The supported formats are

JPG, PNG or GIF.

If you are still unable to upload your logo correctly, please send it to us at

info@ami-project.be for further verification.

Q

Is it possible to send my document to several recipients?

YES

It is possible to send your documents to several recipients.

You can add them to the "Recipients" box of your e-mail by separating them with a comma or a semicolon.

Quotes

Q

How do I create a purchase order?

A purchase order is automatically created when a quote is signed.

Here are the steps for creating a purchase order:

- Quotation creation

- Sending the quotation (you can specify the status "Sent" manually)

- Quotation signature (you can specify the status "Signed" manually)

- You are then automatically sent to the page of the order form created.

- You can then send the order form or download the order form.

- Once the purchase order has been sent, you can invoice it, or create invoices for a deposit.

Q

Can my client sign a quote electronically?

YES

You can

personalize your e-mail to add

an acceptance link and a refusal link.

The status of your quote will be automatically updated, and in case of acceptance the customer will receive the corresponding order form.

Q

The description does not appear on the quote

The description is used when you send your document by e-mail

By default, it appears in the e-mail like this:

"

Following your request, we are pleased to send you the quote { Quote number } for : { Description }"

There are several solutions if you want to

add a visible description on your document:

- A short "customer reference" that will appear in your header

- A general remark, which will appear in the footer

- A line of type "Title" or "Text" which will appear within your settlement

Invoicing

Q

How can I change my invoice number?

If you want

to change your number format, go to "My Settings" then "Set my documents".

Here you can choose between 3 formats:

- With the year, month and number (ex: FA-160 200 001)

- With the year and the number (ex: FA-1600001)

- Only the number (ex: FA-00001)

Important

Regarding the bills, you have the legal obligation to

respect the continuity of your dialing ; so there can not be a "hole" between 2 invoice numbers.

- It is not possible to change the number of a bill.

- It is only possible to delete the last invoice, provided it has not yet been sent.

If you need to create an invoice piece by piece or come back to it later, we recommend using the

invoice templates as a draft.

Then import them into a blank invoice to finalize and send it to your customer.

Q

Can I write an invoice without any VAT ?

YES

You can specify a default VAT rate of 0% in "My Settings> Set My Documents".

It is also possible to specify a VAT of 0% for certain lines of your invoice.

Finally, you can choose not to display any VAT information on your documents by checking the box in "My Settings> Customize My Documents"

Q

Can I add default interest on my invoices?

YES

You can manage your different late payment interest rates in the "Set up my documents" section.

Then you just have to select the rate in the toolbar when you create your invoice.

Late fees will be automatically calculated in your reminder emails.

Q

How to invoice a quote?

Before invoicing a quote, it is necessary to create the purchase order

Here is the complete procedure step by step:

- Create your quote

- Send your quote or specify its status to "Sent by mail"

- Specify the quote status to "Signed"

- Step 3 creates the purchase order and sends you to it automatically

- Send the order form or specify its status to "Sent"

- "Bill the order" and "Create a deposit invoice" buttons are now available

- To invoice the entire quotation, click on the button "Invoice the order" and save the invoice

Q

Import my bank statements to synchronize payments

Synchronize your bank statements

Import your bank statements in CSV* format to automatically record invoice payments and update your cash flow.

(*) The procedure for obtaining your bank statements in CSV format depends on your bank.

Log in to your homebanking and look for a "CSV" (BNP Paribas Fortis) or "Export" (Belfius) button.

Q

How to invoice a purchase order?

When an estimate is indicated as SIGNED, the corresponding purchase order is automatically created.

To

invoice a purchase order it is necessary to send it beforehand to your customer.

Once the status of the purchase order indicated as SENT two new options appear in the tools menu:

- Create a deposit invoice

- Bill the order

To

invoice the entire order, click to open the pre-filled document editor with all the order data, allowing you to modify the content if necessary.

To

create a deposit invoice, click to open a popup allowing you to specify the

percentage of the deposit (pre-filled with the default value), as well as its description.

Q

How to apply the co-contracting regime?

If you are subject to the

contracting party regime you must check the corresponding box on the "Change my details" settings page.

Then, when you select a

customer subject to VAT the contracting regime will be automatically applied (VAT of 0% and addition of the clause in remark).

Q

How to delete my invoice?

With regard to invoices, you have the legal obligation to respect the continuity of your numbering; there can be no "hole" between 2 invoice numbers.

It is therefore only possible to delete the last invoice, provided it has not been sent yet.

To cancel the invoice at the accounting level you must create a credit note.

To credit your bill, set the status to "Sent", which will bring up the "Create a credit" button in the left menu.

Click the button, save your credit note and send it there (or specify its status manually).

If you need to fill out an invoice as you go along or come back to it later, we recommend that you use the invoice models as draft.

Then import them into a blank invoice to finalize and send to your customer.

Q

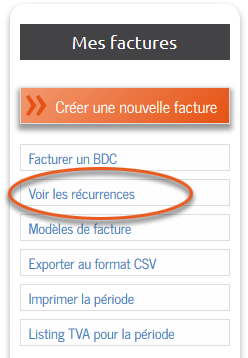

Is it possible to create recurring invoices?

YES

Do you want to

bill your customers regularly based on a predefined invoice template?

It's possible !

Add an

invoice recurrence, defined by:

- the choice of a model

- selecting a customer

- the accuracy of the period (weekly, monthly or yearly)

- the date of the first execution

The invoice will be created and automatically added to your account.

If you would like it to be sent as well, check the box and make sure that your client has agreed to receive your electronic documents.

NOTICE:

This feature is reserved for users with annual access.

Q

Why is my invoice not included in the dashboard?

Invoices are only counted on the scoreboard once sent to your customer.

Until the moment of sending, an invoice can be modified or even deleted if it is the last one (there can not legally be a hole in the numbering).

If you want to create an invoice for later use, we advise you to create and use templates.

Business expenses

Q

How to encode professional expenses ?

The professional expenses form allows for encoding the main informations needed for accounting and VAT and tax statements.

Main informations

- Expense description : memento field (ex.: "June gas", "Computer purchase", "Cellphone invoice", ...)

- Expense reference : invoice number, reference

- Expense type : expense category (pre-encoded or personnalized)

- Purchase type : merchandise, goods, services, ... (information useful to VAT statement)

- Expense date : expense date (used for sorting order and period statements)

- Payment date : payment date of the expense

- Payment mean

- Place of purchase

Amount

- Total VAT included : total amount VAT included

- Ratio pro : professional percentage

- Pro amount tax excluded : pro amount tax excluded (calculated value)

VAT data

- VAT amount : total amount of VAT

- VAT rate : VAT percentage (calculated value)

- Ratio VAT max : the VAT maximum ratio is an accounting rule linked to the expense type (ex.: 50% for cars, 0% for restaurants, ...)

- Deductible VAT : amount of deductible VAT (calculated value)

- Cocontracting rule : VAT rule concerning the cocontracting workers (building company, gardener, ...)

Tax data

- Rejected expenses : the "rejected expenses" is a percentage linked to the exepense type (ex.: 31% for restaurants, ...)

- Deductible amount : deductible amount after the rejected percentage taken into account (calculated value)

- Depreciation : concerns to goods wearing off by time

- Nb years : number of yearsfor depreciation

- Yearly deduction : yearly deductible amount (calculated value)

Colors

- Background color : background color of the line in the expenses list

- Text color : text color of the exepense showing in the list

- Save those parameters for futurs expenses of this type : save the colors and parameters for further expenses of this type

Q

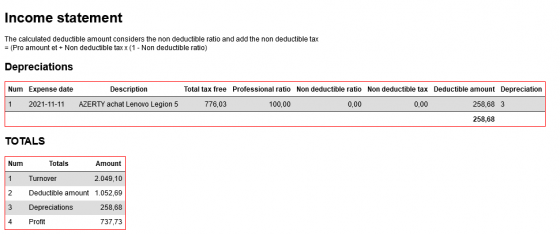

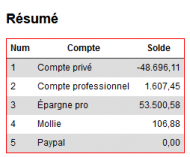

How do I know my tax situation?

Your tax status is displayed in the "Expenses" section.

You will find a summary of invoiced, deductible and due VAT in the toolbar on the left.

To view the summary of a given period (a quarter for example), you can use the "Period" menu in the top search bar, or even specify the dates "From " and "To"

Q

How to manage depreciation ?

Above a defined amount (250 € in Belgium), the professionnal expenses have to be depreciated in several years.

No need for complicated tables anymore,

just input the number of years of depreciation inside the expense form and AMI will take care of all the calculations for the yearly deductions (visible in the taxes estimate and the accounting results).

The depreciation duration depends of the object and the usage you'll make of it.

In general most accountants use standard durations, such as :

- new vehicle : 5 years

- used vehicle : 3 years

- computer: 3 years

All self-employed people are required to keep a cash book as part of their accounts

.

This book contains all the transactions carried out on your company's accounts.

Many self-employed people still record this in spreadsheets such as Excel, which can lead to numerous errors.

The good news is that AMI Project offers you automatic, centralized encoding!

Incoming (business expenses) and outgoing (sales invoices) transactions will be added automatically.

For others (payment of VAT statements, transfers between accounts, etc.), you can still add them manually.

At the end of the year, export your summary for printing, or save it to attach to your tax return.

Q

Is it possible to remove a type of expense?

Your accounting must remain intact for 7 years.

It is therefore not possible to delete an expense type that is still in use, even if it is from previous years.

However, if you wish to delete an unused expense type, you can communicate this to us via e-mail or technical support.

Q

How do I import/export my accounting?

You can import and export your business expenses in CSV format.

- To communicate with another accounting program

- To make your backup copies

The CSV file format is readable by Excel or any other spreadsheet program (Libreoffice Calc for example).

To know the name of the different supported columns, click once on the "Export to CSV" button to get a sample file.

To date, the supported columns are as follows:

- expense_date : expense date (format YYYY-MM-DD)

- location : country

- zone : expense zone (local, EU, abroad)

- kind : kind of expense (service ou product)

- reference : expense reference (invoice number)

- description : expense description (free text)

- total_tax_included : total amount including VAT

- professional_ratio : professional percentage

- non_deductible_ratio : non-deductible percentage

- pro_amount_tax_free : professional amount excluding VAT

- deductible_amount : deductible amount (applied non-deductible percentage)

- depreciation : number of years of depreciation (1 = no depreciation)

- tax_max_ratio : maximum VAT deduction percentage (VAT ceiling)

- tax_amount : total amount of VAT

- tax_counterparty : co-contracting rule (0 ou 1)

- tax_rate : VAT rate on invoice

- tax_rate_local : local VAT rate (for the calculation of intra-community or co-contracting VAT)

- deductible_tax : amount of deductible VAT

- non_deductible_tax : non-deductible VAT amount (see VAT ceiling)

- payment_date : payment date (format YYYY-MM-DD)

- payment_status : payment status (paid, unpaid, partial)

- payment_mean : payment mean (free text)

- expense_type : type of expense (miscellaneous or free text)

- creation_date : date of encoding of the expense (format YYYY-MM-DD)

Clients

Q

How can I import my customers database ?

The buttons "Import CSV " in "Clients" allows you to transfer your database .

CSV functions as a simplified Excel spreadsheet that contains the data .

Most tabs and accounting programs are able to export this kind of file.

To know our current format, the easiest way is to export once the file by clicking "Export to CSV " .

This will give you an overview of the different columns you can add.

ATTENTION : no processing will be performed during the import, make sure the data is accurate (VAT number, email address , etc.)

Some programs like Excel offer different options when exporting CSV, be sure to choose the encoding "UTF-8 without BOM " and the semicolon separator (;).

Q

Why do my clients have to accept my electronic documents?

Electronic invoicing is still young and some legal constraints apply to it.

If you want to send your documents via personalized emails on AMI Project, it is necessary to make sure that your customers accept them.

Simply

check the box "I wish to send my documents electronically to this client" in your client's form.

An

email containing the acceptance link will be sent, and you will be automatically notified of its response.

To customize the acceptance email, go to "My Settings> Personalize My Email" and select "Electronic Billing Warning" from the drop-down menu.

The answer can have the following values:

- Accepted

- Not accepted

- Not asked

Clients payments

Q

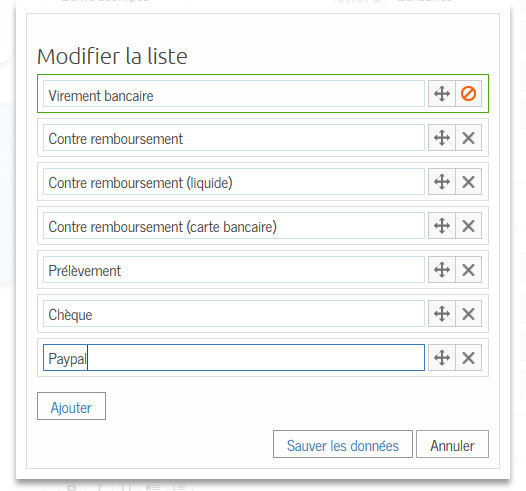

Is it possible to add a payment mean ?

Yes, it's possible.

You can edit your parameters lists in the "Parameter my documents" section, by selecting the "Edit my list" in the corresponding dropdown menu.

A new bloc will appear which allow you to organize your different options.

To go even further, you could for example also specify your Paypal informations inside the global information text block.

Q

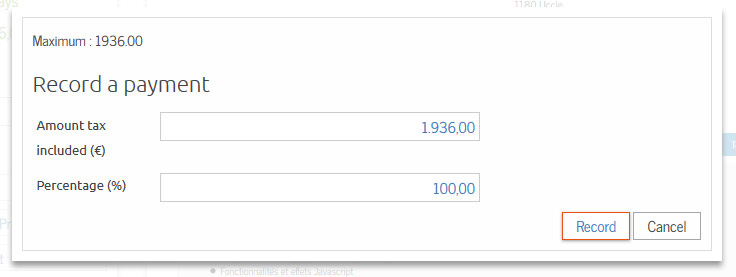

How to record a payment ?

Once your invoice is sent to your client, the option to "Record a payment" appears.

On press, this button opens a small form to specify the amount (in currency or percent).

A payment can be partial ou total.

Payements history is then shown bellow the menu, to the left of your invoice.

Articles and stock

Q

How is the stock updated?

The stock of your materials is settled automatically when your invoice is indicated as sent (via AMI Project or by you).

Conversely, a sent credit note increases your stock.

Q

Why is the VAT rate on my items locked at 0%?

Your company is probably set as not subject to VAT.

The normal rate for this type of business is 0%.

If you wish to charge other VAT rates it is necessary to check the "taxable" box and register a valid VAT number.

Q

Can I set the price of my items to 3 or 4 decimal places?

YES

You can use up to 4 decimals.

To change the number of decimals, choose the value in "My settings > Set my documents".