Frequently asked questions

You couldn't find the answer you're seeking ?

OR

Business expenses

Q

How to encode professional expenses ?

Q

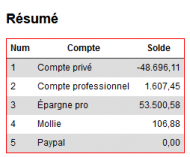

How do I know my tax situation?

Q

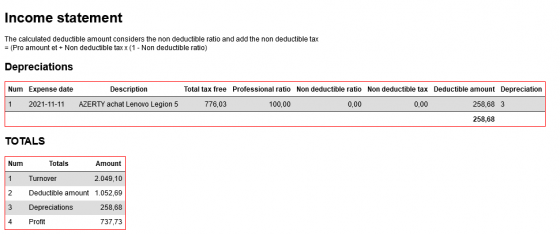

How to manage depreciation ?

Q

Managing cash book

Q

Is it possible to remove a type of expense?

Q

How do I import/export my accounting?