Frequently asked questions

You couldn't find the answer you're seeking ?

OR

General questions

Q

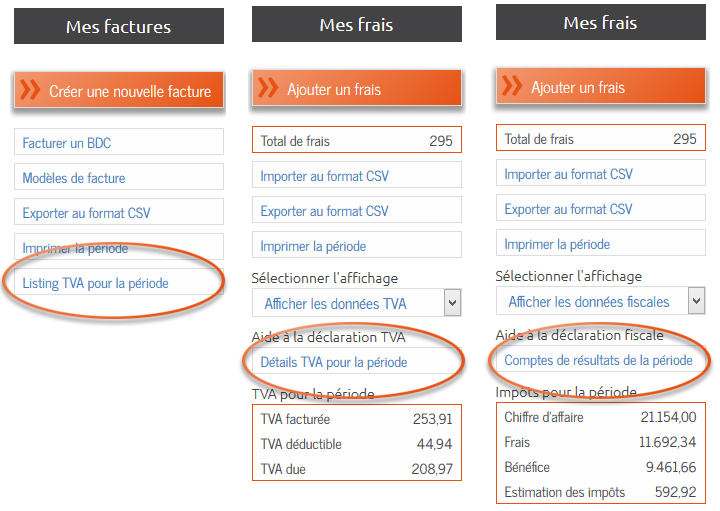

Can I use AMI if I'm not subject to VAT or mixed subject to VAT ?

Q

Can I export my data?

Q

Is AMI suitable for companies working in the construction industry?

Q

May AMI be used by non-professionals ?

Q

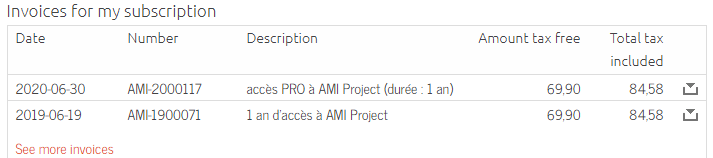

Where can I find my invoice for the purchase of an AMI Project access?

Q

Is AMI Project compatible with Mac OSX?

Q

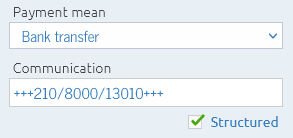

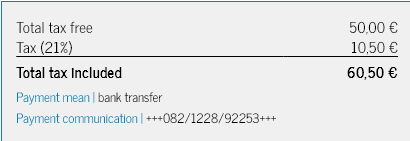

Bank payment communication

Q

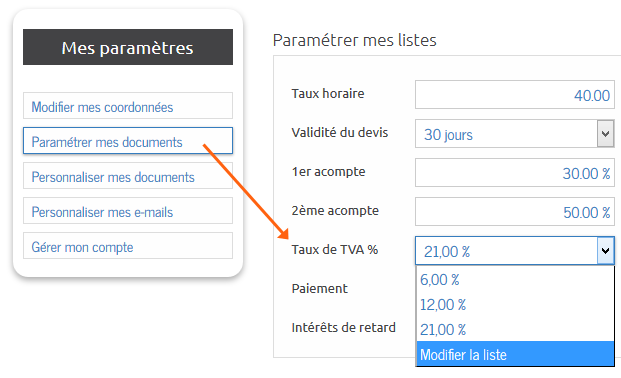

I am a TVA franchisee, how do I set up my account?

Q

Change the duration of the active session

Q

Can I use 2 accounts simultaneously?

Q

Can I use a VPN to connect to AMI Project?